Professional Designations

APC is proud to sponsor employees who earn Professional Designations through both the National Institute of Pension Administrators (NIPA) and the American Society of Pension Professionals & Actuaries (ASPPA), as well as the Internal Revenue Service (IRS).

We have over 20 employees with designations in every category, including the IRS Enrolled Retirement Plan Agent (ERPA) classification and multiple Enrolled Actuaries.

Enrolled Actuary

An Enrolled Actuary is an actuary who has been licensed by a Joint Board of the Department of Treasury & Department of Labor to perform a variety of actuarial tasks that are required for pension plans in the U.S.

The application process and testing are vigorous to become an Enrolled Actuary and most Third Party Administrators do not retain them on staff. Some more common tasks that Enrolled Actuaries perform include complex plan determination, calculation of annual funding, sign-off of required tax reporting, and determination of benefits, just to name a few.

Enrolled actuaries are licensed to practice before the IRS and are subject to extensive continuing education requirements on an ongoing basis.

NIPA Designations

Accredited Pension Administrator (APA)

The APA designation is earned by the successful completion of four study courses and examinations covering all aspects of plan administration.

Any person with two or more years of experience in plan administration may take APA examinations.

Accredited Pension Representative (APR)

An APR covers the fundamentals of retirement plans with an emphasis on defined contribution plans and investment philosophy. This designation requires a FINRA Series 6, 7, 65, 66, or 24 license, an insurance license or alternate designation, allowing an individual to represent clients before the IRS.

The designation provides a solid background for the retirement plan professional, financial consultants/planners and Registered Investment Advisors in the arena of qualified plans.

ASPPA Designations

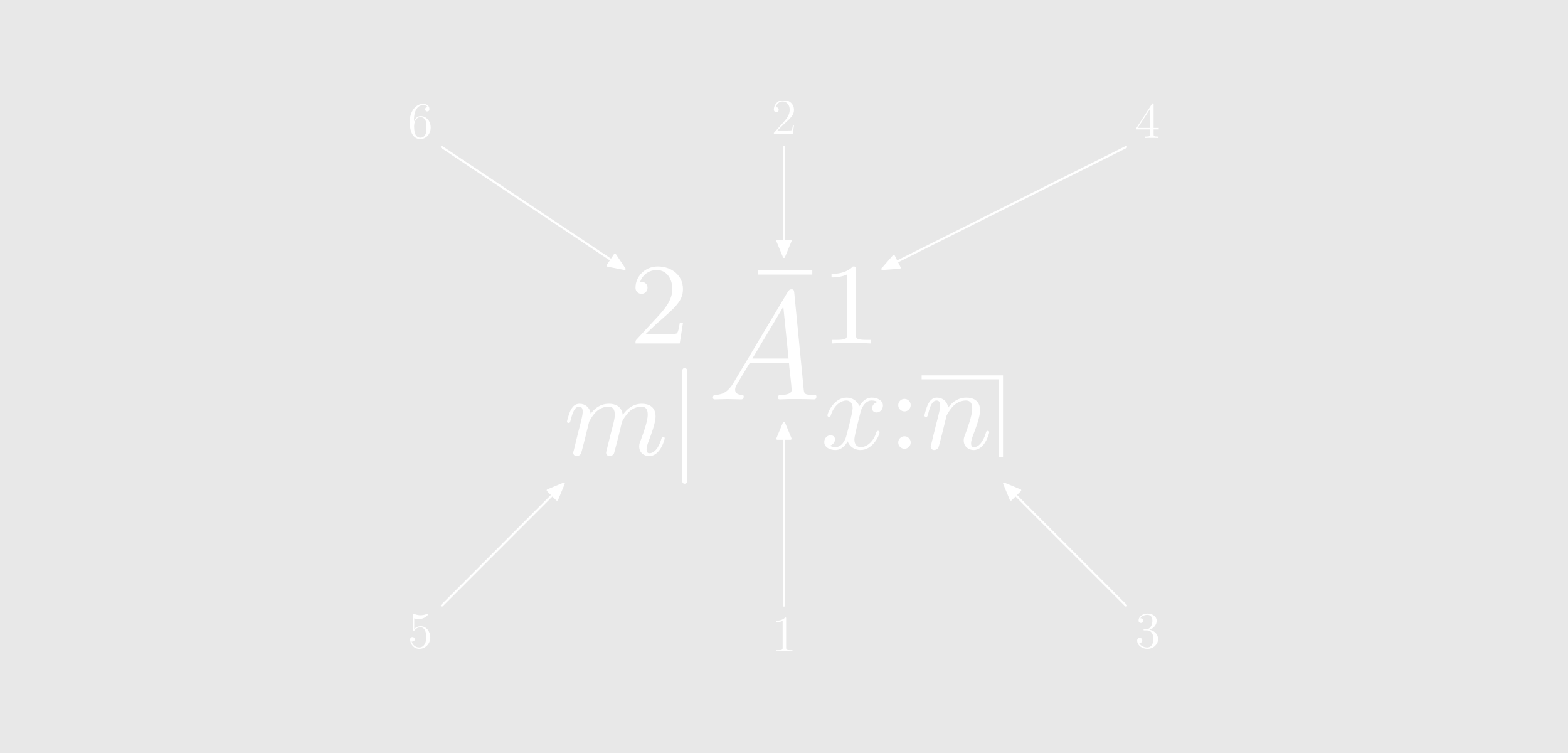

Certified Pension Consultant (CPC)

The CPC credential is offered by ASPPA to benefit professionals working in plan administration, plan actuarial administration, insurance, and financial planning.

The CPC works with employers to formulate, implement, administer, and maintain qualified retirement plans. Individuals with at least three years of plan consulting experience may apply to the ASPPA Board of Directors for CPC credentials after successful completion of the CPC examination series.

Qualified Pension Administrator (QPA)

The QPA credential was created by ASPPA to recognize professionals who are qualified to perform the technical and administrative functions of qualified plan administration.

Candidates, with at least two years of pension-related experience, may apply for this credential after successful completion of the ASPPA QPA examination series.

Qualified 401(k) Administrator (QKA)

The QKA credential recognizes retirement plan professionals who work primarily with 401(k) plans.

Applicants for the QKA credentials are from various professional disciplines. They typically assist employers and consultants with the recordkeeping, non-discrimination testing, and the administrative aspects of 401(k) and related defined contribution plans.

IRS Designation

Enrolled Retirement Plan Agent (ERPA)

The ERPA is a classification of professionals allowed to practice before the IRS.

The IRS recognizes that retirement plan professionals are highly competent in their field and play an active, critical role in representing employers before the IRS on retirement plan matters. The ERPA designation is issued and maintained by the IRS through the IRS Office of Professional Responsibility. To earn the ERPA designation, individuals must successfully complete a two-part ERPA Special Enrollment Examination as well as tax compliance and background checks. Effective in 2016, the IRS will no longer certify new Agents but existing ERPA’s will retain the designation and rights assigned. APC currently has several employees who are Enrolled Retirement Plan Agents.